Applying Machine Learning to Financial Risk Assessment in R

Applying Machine Learning to Financial Risk Assessment in R, financial risk assessment is a crucial process in the financial industry that involves evaluating potential threats and vulnerabilities to financial institutions or individuals.

Traditionally, risk assessment was performed manually, but with the advancement in machine learning, it is now possible to automate the risk assessment process using various statistical and computational techniques.

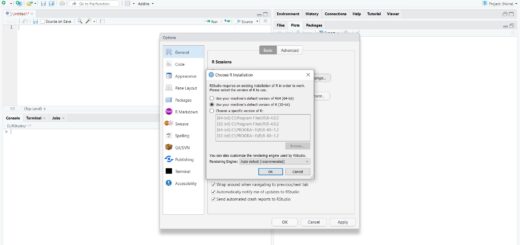

R is a popular open-source programming language for statistical computing and graphics. It provides a wide range of tools for performing data exploration, visualization, and modeling, making it a popular choice for financial risk analysis.

In this article, we will explore how machine learning techniques can be applied to financial risk assessment using some built-in datasets in R.

How to Prepare a Machine Learning Interview? » Data Science Tutorials

Data Preparation

Before we can apply machine learning to financial risk assessment datasets, we must first prepare our data.

In financial risk assessment, the data typically involves financial transactions made by individuals or institutions that may or may not be fraudulent.

In this example, we will use the “creditcard.csv” dataset, which contains anonymous credit card transactions made by European cardholders over two days in September 2013.

The data has 30 features, where 28 of them are transformed through Principal Component Analysis (PCA) due to confidentiality reasons.

The two remaining features are the “Amount” and “Class” variables, where the class variable indicates whether the transaction is fraudulent or not.

Applying Machine Learning to Financial Risk Assessment in R

# Load dataset (Huge data set maybe will take a little time to load depending on your system memory)

creditcard <- read.csv("creditcard.csv")# Check dimensions

dim(creditcard)

284,807 rows & 31 columns

We can see the dimension of the dataset has 284,807 rows and 31 columns.

# Check the first few rows

head(creditcard)

Time V1 V2 V3 V4 V5 V6 V7 V8 1 0.000000e+00 -1.359807e+00 -0.072781173 2.536346737 1.37815523 -0.33832077 0.462387778 -0.575418888 0.097781921 2 0.000000e+00 1.191857e+00 0.266150712 0.166480113 0.44815408 0.06001765 -0.082360809 0.222792927 0.081564444 3 1.000000e+00 -1.358354e+00 -1.340163075 1.773209343 0.37977959 -0.50319813 1.800499381 0.499150349 0.207642865 4 1.000000e+00 -3.383207e-01 -0.450311292 1.792993340 -0.86329128 -0.01030888 1.247203168 -0.657305395 0.753074433 5 2.000000e+00 -1.158233e+00 0.877736755 1.548717847 0.40303393 -0.40719338 0.095921462 -0.571410687 0.310796545 6 2.000000e+00 -6.264443e-01 0.310474905 0.773083018 0.92933700 0.59294075 -0.354573999 0.570328167 0.249146690 V9 V10 V11 V12 V13 V14 V15 V16 V17 1 0.36378697 0.090794172 -0.55159953 -0.61780086 -0.991389847 -0.31116935 1.468176972 -0.47039992 0.207971242 2 -0.25542513 -0.166974414 1.61272666 1.06523531 0.489095015 -0.14377230 0.635558093 0.46391704 -0.114804663 3 -1.51465432 0.207642865 0.62450146 0.06608369 0.717292731 -0.16594592 2.345864949 -2.89008319 1.109969379 4 -1.38702406 -0.054951922 -0.22648726 0.17822823 0.507756869 -0.28792374 -0.631418118 -1.05964725 -0.684092786 5 0.81773931 0.753074433 -0.82284288 0.53819555 1.345851593 -1.11967022 0.175121131 -0.45144918 -0.237033239 6 -0.56867138 -0.371407197 -1.42654532 -0.08901978 -0.040296099 -0.13713494 -0.094643880 -0.09471056 -0.073548434 V18 V19 V20 V21 V22 V23 V24 V25 V26 V27 1 0.02579058 0.40399296 0.2514121 -0.01830678 0.277837576 -0.110473910 0.06692807 0.12853936 0.04416235 0.02191957 2 -0.18336127 -0.14578304 -0.0690831 -0.22577525 -0.638671953 0.101288021 -0.33984648 0.16717040 -0.03991204 -0.06426102 3 -0.12135931 -2.26185710 0.5249797 0.24799815 0.771679401 0.909412262 -0.68928096 -1.3276428 0.10826276 0.25391446 4 1.96577500 -1.23262197 -0.2080378 -0.10830045 0.005273597 -0.190320519 -1.17557533 0.6473764 -0.92814220 0.08177524 5 -0.03819479 0.80348692 0.4085424 -0.00943070 0.798278495 -0.137458079 0.14126698 -0.2060096 0.65105048 0.06766320 6 0.31389444 -0.05504547 0.0849674 -0.20825352 -0.559825872 -0.026397667 -0.37142721 -0.2327938 -0.20600950 0.00576608 V28 Amount Class 1 -0.0153868 149.62 0 2 0.0646123 2.69 0 3 -0.0172126 378.66 0 4 0.0029224 123.50 0 5 0.0618580 69.99 0 6 0.0059673 3.67 0

We can notice that the “Amount” and “Class” columns are the only ones that are not transformed through PCA.

We can further explore the dataset by checking if there are any null or missing values as this can affect our analysis.

Check for missing values

sum(is.na(creditcard)) 0 missing values

We can see that there are no missing or null values in the dataset.

Model Building & Evaluation

After preparing the data, we can now proceed with building and evaluating the machine learning model.

# Load required libraries

library(glmnet) library(caret)

# Split data into training and testing sets

set.seed(123) train_index <- createDataPartition(creditcard$Class, p = 0.7, list = FALSE) train_data <- creditcard[train_index, ] test_data <- creditcard[-train_index, ]

In this example, we will use logistic regression and random forest machine learning algorithms to build our model.

Logistic Regression model

fit_glmnet <- cv.glmnet(as.matrix(train_data[, -31]), train_data$Class, family="binomial", alpha = 1)

Random Forest model

rf_model <- randomForest(Class ~ ., data = train_data, ntree = 1000, mtry = sqrt(ncol(train_data) - 1))

To evaluate the performance of our models, we will use the Area Under the Receiver Operating Characteristic Curve (AUC-ROC) and the Confusion Matrix.

Logistic Regression Evaluation

prob_glm <- predict(fit_glmnet, as.matrix(test_data[, -31]), type = "response")

colnames<-`(cbind(prob_glm, test_data$Class), c("Prob", "Class"))

glm_perf <- performance(pred, "auc")

plot(glm_perf)

confusionMatrix(table(test_data$Class, pred_class))Random Forest Evaluation

rf_prob <- predict(rf_model, test_data[, -31], type = "prob") rf_class <- as.numeric(rf_prob[, '1'] <= 0.5) rf_perf <- performance(prediction(rf_class, test_data$Class), "auc") plot(rf_perf) confusionMatrix(table(test_data$Class, rf_class))

The confusion matrix tells us how well our model is predicting fraudulent transactions and non-fraudulent transactions.

The AUC-ROC score tells us how well our model is distinguishing between the two classes.

The closer the AUC-ROC score is to 1, the better our model can predict fraudulent transactions.

Conclusion

In conclusion, machine learning has revolutionized financial risk assessment by enabling institutions to automate the risk assessment process and detect potential fraudulent transactions.

In this article, we explored how machine learning can be applied to the credit card dataset using R.

We demonstrated how to prepare the dataset, split it into training and testing sets, and build machine-learning models using logistic regression and random forest techniques.

Finally, we evaluated the performance of our models using the confusion matrix and AUC-ROC score.

Find confidence intervals in R

Hi,

the Data Set you can access from the below link.

https://www.kaggle.com/mlg-ulb/creditcardfraud

Now retrieving an image set.

The Art of Statistics

₹437.00 (as of July 3 23:00 GMT +07:00 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)