Data Science Applications in Banking

Data Science Applications in Banking, Companies require data in order to gain insights and make data-driven decisions.

Data science is a requirement for providing better services to customers and developing strategies for various banking operations.

Furthermore, banks require data in order to expand their operations and attract new customers.

We will go over some of the key areas where banking industries are utilizing data science to improve their products.

Data science will play a significant role in the banking sector.

Top Data Science Applications You Should Know 2023 (datasciencetut.com)

Data Science Applications in Banking

Here are six fascinating data science applications for banking that will show you how data science is changing the banking industry.

1. Risk Modeling

The banking industry places a high value on risk modeling. It assists them in developing new strategies for evaluating their performance.

One of its most important aspects is credit risk modeling. Banks can use credit risk modeling to predict how their loans will be repaid.

There is a risk that the borrower will be unable to repay the loan in credit risks. There are numerous factors in credit risk that make it a difficult task for banks.

Banks can use Risk Modeling to analyze default rates and develop strategies to strengthen their lending schemes.

Banking industries can use Big Data and Data Science to analyze and classify defaulters before sanctioning loans in high-risk scenarios.

Risk modeling also applies to the overall operation of the bank, where analytical tools are used to quantify and track the performance of the banks.

How to move from Junior Data Scientist – Data Science Tutorials

2. Fraud Detection

Machine learning advancements have made it easier for businesses to detect fraud and irregularities in transactional patterns.

Fraud detection entails monitoring and analyzing user activity to identify any unusual or malicious patterns.

The number of frauds has increased significantly as people’s reliance on the internet and e-commerce for transactions has grown.

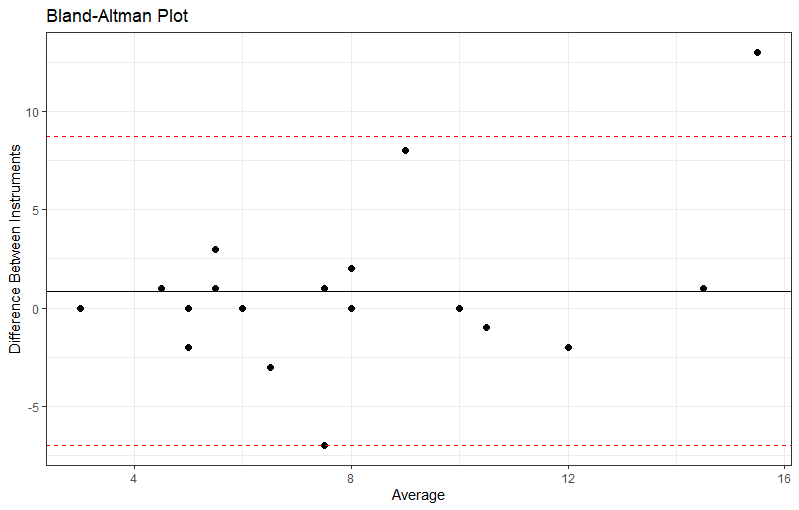

Data Science Fraud Detection Process

Industries can use data science to harness the power of machine learning and predictive analytics to create clustering tools that will aid in the recognition of various trends and patterns in the fraud-detection ecosystem.

There are several algorithms, such as K-means clustering and SVM, that can be used to build a platform for recognizing patterns of unusual activities and transactions.

Fraud detection entails the following steps:

- Obtaining data samples for model training.

On the given datasets, we trained our model. The training process entails the use of several machine-learning algorithms for feature selection and classification.

2. Model is being tested and deployed.

For example, K-means clustering and SVM can be used for data preprocessing and classification. K-means can be used to select features, and SVMs are then applied to the data to determine whether it is fraudulent or not.

Boosting in Machine Learning:-A Brief Overview (datasciencetut.com)

3. Customer Lifetime Value

Customers are critical components of the banking industry. They ensure a consistent flow of revenue.

A Customer Lifetime Value, in formal terms, is a discounted value of future revenues contributed by the customer.

Banks are frequently required to forecast future revenues based on historical data.

Banks are also interested in customer retention and whether they will contribute to revenue generation in the future.

Banks want to satisfy their customers and nurture them for both current and future opportunities.

Businesses, such as banks, must forecast their customer lifetime value. In this section, data science in banking is critical.

Banks can use predictive analytics to categorize potential customers and assign them significant future value in order to invest company resources in them.

While classification algorithms assist banks in acquiring new customers, retaining them is a more difficult task.

With the increase in competition, banks require a comprehensive view of their customers in order to channel their resources in the most efficient manner.

There are numerous tools available for data preprocessing, cleaning, and prediction.

Classification and Regression Trees (CART), Generalized Linear Models (GLM), and other tools are available.

This enables banks to monitor their customers and contribute to the company’s growth and profitability.

Algorithm Classifications in Machine Learning – Data Science Tutorials

4. Customer Segmentation

Banks segment their customers based on their behavior and shared characteristics in order to address them appropriately.

Machine learning techniques such as classification and clustering play an important role in determining potential customers as well as segmenting customers based on their common behaviors in this scenario.

K-means is a popular clustering technique that is widely used for clustering similar data points.

It is an unsupervised learning algorithm, which means that the data on which it is applied lacks labels and an input-output mapping.

Customer segmentation can help banks in a variety of ways, including the following:

- Customers are identified based on their profitability.

- Customers are segmented based on how they use banking services.

- Customers’ relationships are being strengthened.

- Providing appropriate schemes and services to specific customers.

- The customer segment analysis is used to implement and improve services.

How to Avoid Overfitting? – Data Science Tutorials

5. Recommendation Engines

One of the most important roles that a bank play is in providing customized experiences to customers.

To suggest offers and extended services based on customer transactions and personal information.

After analyzing previous purchases, banks can also predict which products a customer might be interested in purchasing.

Banks will be able to recommend the products of companies that have partnered with them as a result of this.

Based on their preferences, it also suggests customer-centric or product-centric offerings. Banks can also recommend highly appealing offers to customers.

Banks use one of two types of recommendation engines:

- Collaborative Filtering Based on User Input

- Collaborative Filtering Based on Items

Making games in R- Nara and eventloop Game Changers (datasciencetut.com)

6. Real-Time Predictive Analytics

Predictive analytics is the process of predicting future events using computational techniques. Machine Learning is the main predictive analytics toolbox.

Machine Learning is an excellent tool for improving banks’ analytical strategies.

With the rapid increase in data, there is an abundance of use cases, and the importance of data analysis is at an all-time high.

Major analytics techniques are classified into two types:

- Analytics in real-time.

- Analytics that predicts the future.

Customers can understand problems that are impeding their businesses thanks to real-time analytics. Predictive Analytics, on the other hand, enables customers to choose the best technique for solving problems.

Financial management in banking sectors, for example, enables industries to manage their finances and devise new strategies.

Data Science Challenges in R Programming Language (datasciencetut.com)

Summary

Finally, we conclude that data science plays a significant role in banking. Banks all over the world analyze data to provide better customer experiences.

Several key areas include fraud detection, risk modeling, customer lifetime value, real-time predictive analytics, and so on.

I hope you had a pleasant experience reading this blog. Share your valuable feedback in the comments section; it means a lot to us.